Digital Gold and Silver: Enter Kinesis

I’ve recently started taking a closer look at Kinesis as another option for precious metals. Holding physical is of course the way to go but what if you run out of room in your safe or hiding places in your home? You’ll need a backup plan. What if that backup plan let you take custody of that digital gold and silver as well? What if you’re never charged a storage fee for it and can earn a 6,99% yield on it too? (The APY is for holding KAU only and based on the master fee pool) Do NOT confuse this with the PAX gold crypto token which is garbage.

Let’s talk about what Kinesis is, and isn’t.

If you’re joining Kinesis you might already be into precious metals or you might want to add them to your already digital portfolio of other things. Both are smart decisions, but buying gold and silver mining stocks is not. As far as myself I’m always thinking about what should I own if the worst happens like I don’t know, a financial collapse. A societal collapse. Food shortages, water shortages, etc. All of these things can happen at any time as they do around the world, books have been written about it warning those of us who haven’t dealt with such things yet.

If something like that were to occur, would I want ALL my metal and valuables stored in my home? No, probably not. I’m going to have enough problems at that point along with the rest of you reading. So storing something elsewhere in the world might be of some benefit. If I end up in Singapore for example, I can pull my gold and silver out of the vault there or 12 other places around the planet. Digital gold and silver isn’t the ultimate arrow to have in your quiver, but its a few additional arrows nonetheless. Kinesis can accomplish this as they sell gold, silver, bitcoin, ethereum, and other digital assets if you so desire safely and remotely elsewhere with no monthly storage fees.

One of many widgets you’ll find in your dashboard

So what is a KAU and a KAG? (Kinesis + metal designation via periodic table of elements, pretty clever) These are the digital equivalents to both gold and silver on the blockchain in contract form. When you buy them, you essentially own that physical gold and silver with no counterparty risk according to Kinesis, as you’re holding the contract of ownership. The amount you’re getting per token is as follows:

1 KAU = 1 fine gram of gold | 1 KAG= 1 oz of silver

So how does it work? You open an account, which actually gets approved pretty quickly. Your photo ID or driver license, a picture of your face, done. It’s more than a bank requires but regulators want more personal data these days on anyone whose not them, go figure. Either way, it’s the cost of entry and my account was actually approved in a few hours. Very simple and I was off and running.

What you don’t want to do is use wire transfers to throw money in here. Again, DON’T DO THIS! Instead, just buy a stable coin on a crypto exchange of your choice like $USDC and deposit that instead to your account address for that particular asset. It is suggested that you don’t move it directly from the exchange to Kinesis as it slows down the process. Instead send it to a software or hardware wallet and then send it over to the Kinesis platform. I’m told it should only take an hour or two to become available at that point. If you use wire transfers you’ll be waiting 3-5 business days.

After purchasing your gold or KAU in this instance, you will begin accumulating a yield on your holdings, (again this is based on the master fee pool the 6.99% is an estimation) and you’ll never be charged for storage. At that point you can keep it in your hot wallet in your account, or you can move it to cold storage if you like. Most will probably just keep it in their hot wallet under 2FA standards of security, but for some folks who have high 5, 6, or 7 figure amounts of assets here, you’ll probably want to do a little better. Unfortunately, there’s only one cold wallet that will work here and I’m not fond of it, the “Cool Wallet.”

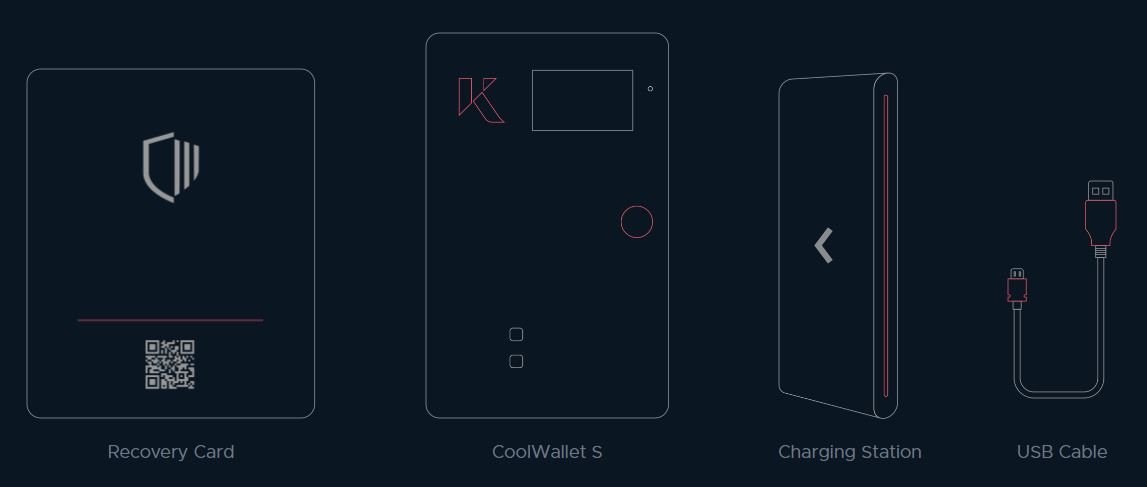

Cold storage on what is exactly the size of a credit card

It looks cool for what it is, but it’s a pain to set up. You don’t get mnemonic words like you do on most other cold storage solutions, you get numbers. 12, 18, or 24 segments of 5 numbers each and that is your seed. After the device generates these, you then have to add up each digit in the seed to verify everything is correct. It also comes with 2 recovery cards in case you ever have to restore a new device and a charging station.

The mobile app is easy enough to use but this thing is just a pain in the ass to get up and running. It is not user friendly and I haven’t the slightest idea why Kinesis would want to partner with CoolBit, the makers of this wallet for their asset exchange when Ledger and Trezor exist. I’m sure the devs over there are great people, don’t get me wrong. It’s simply the execution of the product that I find irritating. The digital silver and gold (KAU & KAG) uses SLIP instead of the BIP44 standard, so perhaps that’s why. But, unfortunately this is literally your only choice, so if you want the best security, you’ll be buying one of these things.

You can purchase it here,

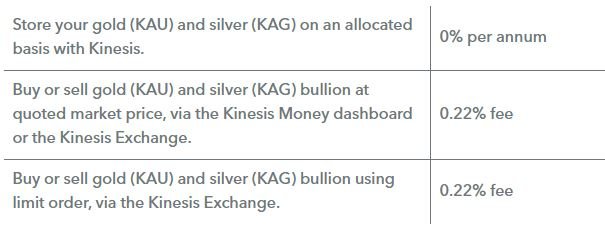

It is a full exchange in every sense of the word

Here you can simply exchange one asset for another or sell into cash or a stablecoin like USDC or Tether and withdraw your funds. You can even use dollars if you prefer. (I recommend $USDC if you’re unsure for speed in and out). But what about premiums? There aren’t any, but there’s fees. Many different types of fees, but they’re all low compared to what you’d pay for physical, they’re a steal.

A fraction of a percent if we’re speaking plainly.

And there is a transfer fee for moving this between the exchange, your wallet, etc.

But even these are relatively nothing. Ever since people started buying physical precious metals and got excited about doing it again the last few years, premiums have shot through the roof. Yes, you get a little break the more metal you buy, but they haven’t been this high in years. The winners in the metal markets right now are the bullion dealers, not the buyers. But Kinesis is now beginning to sell bullion as well, and I have to say it’s very classy looking if you’re in the market. Gold and silver coins and bullion.

You can have a closer look here

1 oz Kinesis Bar

Lady Justice sits at the helm as their first bullion series to be released

There’s more we can talk about here like converting gold and silver that you already have into digital kinesis stuff and earn money on it. Or minting your own and using their debit card, etc but I don’t want to get too far into the weeds of Kinesis. This is simply just an introduction to it so you know it’s out there. There’s far more benefits here than disadvantages. The platform will require some exploring on your part to figure out and they have an instructional series on youtube for new users. You can find that here. But fear not, after signing up you’ll get your own account manager who will be emailing you within 24-48 hours to answer any questions and point you in the right directions for what you’re interested in doing.

Aside from that, if you’ve read this far, you’re probably a serious investor or someone who just wants better options than the legacy ones we’re still using today. If you’d like to open an account on Kinesis, you can do so with my referral link by clicking here. After you join, you can send email referrals to your friends and family and you’ll both receive one free half ounce of silver.

Stay safe out there friends.