Total Financial Collapse Incoming? Be Your Own Bank (Part 2)

So this will be part 2 of this ongoing topic. I wanted to get this out there about six months or so before we really start seeing things snowball here.

In the first part of this series we talked about how the FDIC is a house of cards, the commercial mortgage system is going to implode, and how FTX was nothing more than a money laundering scheme that benefitted US politicians on both sides extremely well in the form of “donations.” Let’s talk about what you should be doing right now to avoid getting side-swiped by the coming financial tsunami that will affect the entire world.

GET OUT OF DEBT, NOW!

This should be obvious but this isn’t just some feel good Dave Ramsey tutelage (He’s telling people to go buy houses right now at 7% while massive layoffs are still happening so he can make some money with his mortgage company). No, you have to truly understand what debt is. Debt is slavery. It’s shackles are invisible and it’s servitude looks like freedom, but it isn’t. Debt is what keeps you going to a job you hate every day to make sure you can keep your house, your car, your kid in private school, and have all those fun and fancy vacations. You’re a slave.

As soon as you stop making those payments you’ll see that all those things you’re renting until paid off in full, go out the window. You’ll be reeling from your home being taken, your cars being repossessed, and claiming bankruptcy on all your unsecured debt you can’t pay back. Your credit score will tank and nobody will lend to you for quite some time, and when they do it’ll be at high APR percentages because you’re considered a risk now. I don’t want that for you. I know people can’t typically pay off things like their home in one payment, but you can move the timeline to ownership up significantly if you focus solely on getting that paid off early. Pay off that car note asap. Get rid of any bs credit card debt you have looming. Get out from under the heavy burden of debt. It will end up owning you if you let it.

“They have us working jobs we hate so we can buy shit that we don’t need. Our Great Depression...is our lives. ”

Enjoy the fruits of your labor, and there’s nothing wrong with rewarding yourself once in a while. But don’t get into massive debt and make yourself a financial slave the rest of your life. The only time debt is actually good is if someone else is paying it off for you because you’re providing them a service with that debt. I.E. Housing, office space, cleaning services, etc.

2. BECOME YOUR OWN BANK!!

I have absolutely zero trust in the legacy banking system. None. It’s run solely on greed and aggressive, foolhardy investments meant to make them rich and us holding the bag when it all comes crashing down. That being said, I’m also not a fan of custodianship. I don’t like other people in charge of keeping my money or individual wealth safe from catastrophe. I believe only I can do that for the most part. If I’m in full control of my own assets, then only I can buy more or sell them when I deem fit. I don’t have to worry about that financial institution collapsing or the government freezing all my assets because I decided to exercise my first amendment rights by being an outlier on a particular narrative. Because that’s EXACTLY what they do. All of these systems from banking, social media, academia, Hollywood, big tech, to pharmaceuticals, are all intricately connected to a system. I and many others call that system “The Matrix” because that’s exactly what it is. A system of control. If you haven’t seen the movie of the same name yet, what are you doing with your life?

Buy Precious Metals

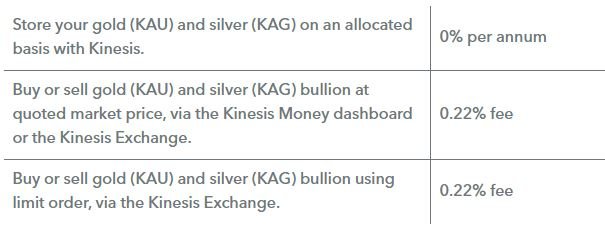

So how do you separate yourself from these systems? How do you escape their grasp? Well, you probably can’t do that entirely unless you fake your own death or something. Standard commerce is all tied to them, but you can minimize the blowback and loss of assets. Do you know what all the global centralized banks are doing right now? Do you know what countries like Russia and China are doing right now? They’re buying gold. Literally tons of it. Now if all the big banks are stockpiling gold while also telling you there’s nothing to worry about, then why aren’t you? Everyone should have at least a 10% allocation in gold and precious metals to retain their personal net worth. I prefer to have more than that, but think of 10% as the bare minimum. Buy it from a reputable coin shop in your area or online bullion dealers. If you don’t have the room to actually store it safely anywhere, make a deposit on the Kinesis platform. If you choose the kinesis option, I recommend buying $USDC on a crypto exchange and sending that to your kinesis wallet to buy and sell gold which you can later exchange for the physical versions if you like from their numerous international vaults. If you store digital gold here, you’ll also earn interest on it.

Another really cool invention within the past few years is goldbacks. I’ve written about them here as well but I’m going to insert another image of them simply because of how cool they are and worth you taking a second glance at. The long and short of it is these are spendable amounts of 24 karat gold that you can spend just like fiat except for the fact that they’re actually made of gold and can’t be inflated to zero. They will always retain value and keep with the price of gold in the markets. Definitely worth owning a few hundred or thousand dollars worth. As of this writing, one Goldback is worth $4.06.

Buy Bitcoin and Ethereum

Although these two digital assets have gone parabolic and then crashed just as hard, the technology hasn’t changed. It’s only gotten better. Why don’t you own any? Although I love the idea of owning physical metals like gold and silver to retain wealth, I also realize that things like Bitcoin and Ethereum actually create wealth. More young people today prefer to own bitcoin instead of those garbage 401K’s we’ve been being sold for decades as good retirement vehicles. And for good reason! There will only ever be 21 million bitcoins that will ever exist and it will take another 140 years give or take to mine them all. You’re technically still early if you look at it from that particular timeline. Still not sure that it’s a good store of value for your portfolio? Go read The Bitcoin Standard and stop being such a normie.

Ethereum is next on the list. It doesn’t function the same way as Bitcoin does, it functions as a smart contract platform. Our future overlords will be running Central Bank Digital Currencies (CBDC’s) on top of the ethereum blockchain in some regards, might as well own some. Furthermore smart contracts will also power things like trustless mortgage loans that will automatically execute after you pay off your property and give you a digital and/or physical deed to your home. There are many supply chain management dApps (decentralized applications) that function on top of this blockchain and much of the defi (decentralized finance) space runs on the ethereum blockchain. It’s just ridiculous not owning any of it at this point as it’s the second most popular digital asset in the world.

Cold Storage

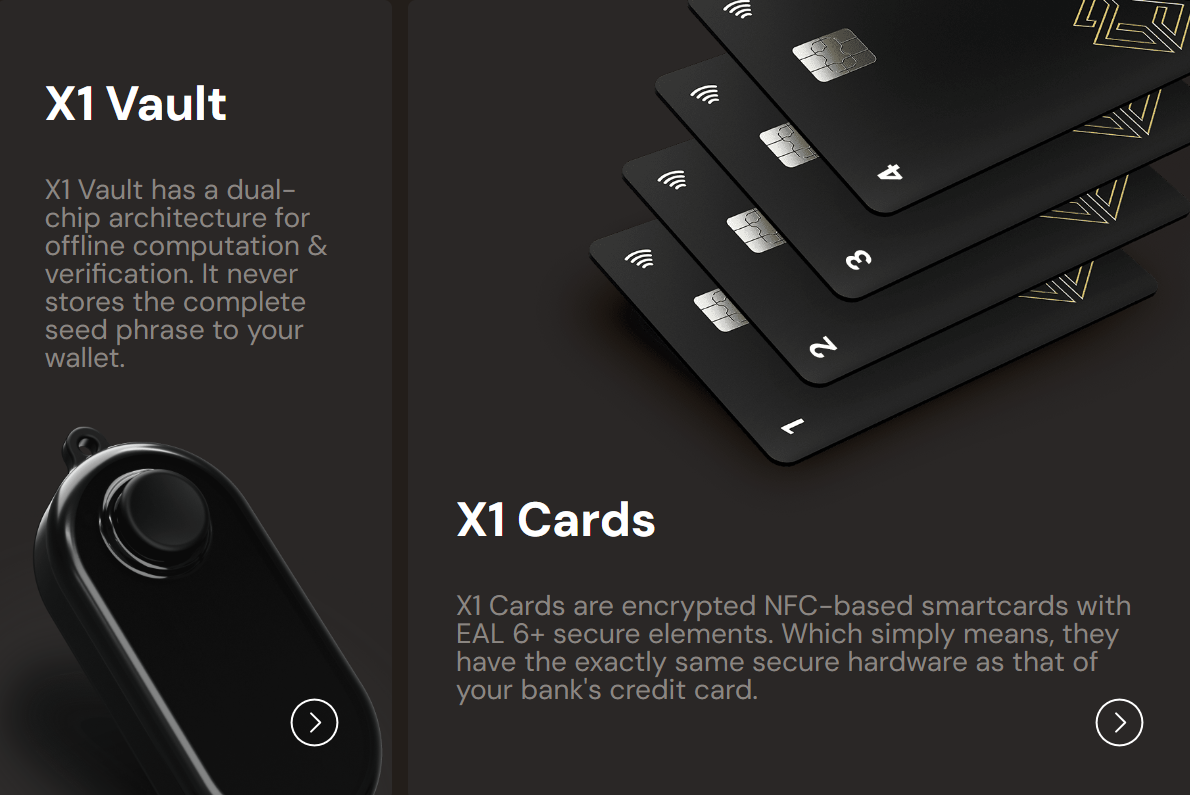

After your entry into Bitcoin and Ethereum, don’t be like all those FTX people and store that stuff on the same exchange you bought it from. Buy yourself a Cypherock (my personal preference) and move your assets to cold storage ASAP. When becoming your own bank you want zero custodianship from someone else as humanly possible. Throughout history, things like custodians over assets has always failed and the assets stolen by someone at some point. Don’t fall into that same trap. We’ve already seen that the FDIC is nothing but fake promises built on a house of cards. The slightest breeze and it all comes crashing down. Be your own bank! Store your own assets!

Cypherock Hardware Wallet- No Seed Phrase Storage Necessary

A major advantage here is what if you try to leave the country and you got a bunch of gold and silver with you. Airports only allow a max of $10k in precious metals to be taken aboard airplanes, per person. Good luck trying to get out with all that silver and gold you’ve stored. But what if you have hundreds of thousands of dollars stored in an equivalent amount of bitcoin or ethereum? Now you’re only going through the TSA at the airport with what looks like a small thumb drive as seen above. OR, you can simply write down your 12 or 24 word seed and restore it on another compatible BIP wallet. With the above Cypherock wallet, you don’t even have to worry about seed phrases. It’s much easier to move wealth in cold storage all over the world on such small physical devices than keeping them in some legacy bank that has to go through numerous intermediaries to even transfer it elsewhere internationally. Even the stone age banks are finally realizing this.

Real Estate

Hard assets are the key takeaway on this one. Something that will at least retain it’s value in the short-term and go up in value in the long-term. Real estate tends to be something you buy AFTER a major financial event, not before. So I am including it here for that type of scenario. When the financial tsunami washes over the world, decimating much of the population, there will be many assets up for grabs. As I’ve said prior, I certainly don’t want this to happen to whomever is reading this right now, far from it. BUT, every time these events occur, there will always be people who never saw it coming. They refused to pay attention to what was going on behind the scenes and instead just took the media’s word that “Everything is going to be fine. Don’t worry!” Well, we see how trustworthy they’ve been in the past, so Real Estate is certainly something you should look into later on when it’s at rock bottom prices. This is another asset class that makes people extremely rich during a collapse or serious economic downturn, providing they were waiting on the sidelines, flush with cash. Even if it’s just naked parcels of land, owning some of it at a low price is rarely a bad idea if you know what to look for. As always, do your own research, but recognize this is a hard asset worth owning at the right price.

Summation

These are some of the best ways of being your own bank. I find it interesting that diehards of both camps hate the people in the other. Metal advocates hate crypto and crypto advocates tend to hate the gold and silver bugs out there. I think it’s ridiculous. Both of these things serve a purpose and serve it well. Gold and silver doesn’t make you rich, it just allows you to keep your wealth when the banks collapse with your money in them (which they’re legally allowed to seize from you), so that you still have value tied to your name when it all goes up in smoke. Bitcoin and ethereum is for creating wealth over the long-term (providing you sell the tops in ethereum and alts when they appear and don’t diamond hand into infinity). And they’re portable. You can take them anywhere you are because they live on the blockchain, not a legacy bank account run by a bunch of greedy old men.

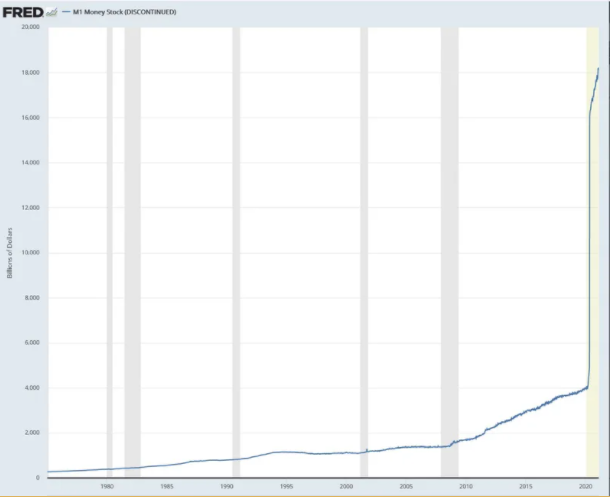

Which method do you prefer? Being your own bank? Or having irresponsible liars in charge of the money you earn that they print out of thin air? I know which one I’ve chosen.

Lastly, here is all of the world’s money in one visualization, click here. Now imagine most of that on fire. At the end of the day, we don’t know what’s going to happen in the next 6 months. I believe the CMBS market is going to take a massive hit with lending, remote work, etc but then again, nothing may happen. But this financial system we’re all a part of is a ticking time bomb and has been for years. Nothing negative is going to happen to you by taking the steps listed here and holding those assets. Getting out of debt short circuits your indentured servitude to a system programmed to fail with no survivors.

Regardless of what your plans are, I wish you the best in the coming turbulence. Be safe out there and be ready for any impending doom that’s once again coming to ravage the world. The international banking cartels.